Don't miss out on local tips, events and market insights.

CLICK PLAY FOR YOUR LATEST MARKET UPDATE

For Northern NJ | September, 2025

Hope you got value from our market update. If you ever want the specifics for your neighborhood, send us an email and we'll share the data with you.

More Market Updates in Your Area!

Northern New Jersey Real Estate Market Update | Fall 2025 Trends & Insights

Northern New Jersey Real Estate Market Update – Fall 2025

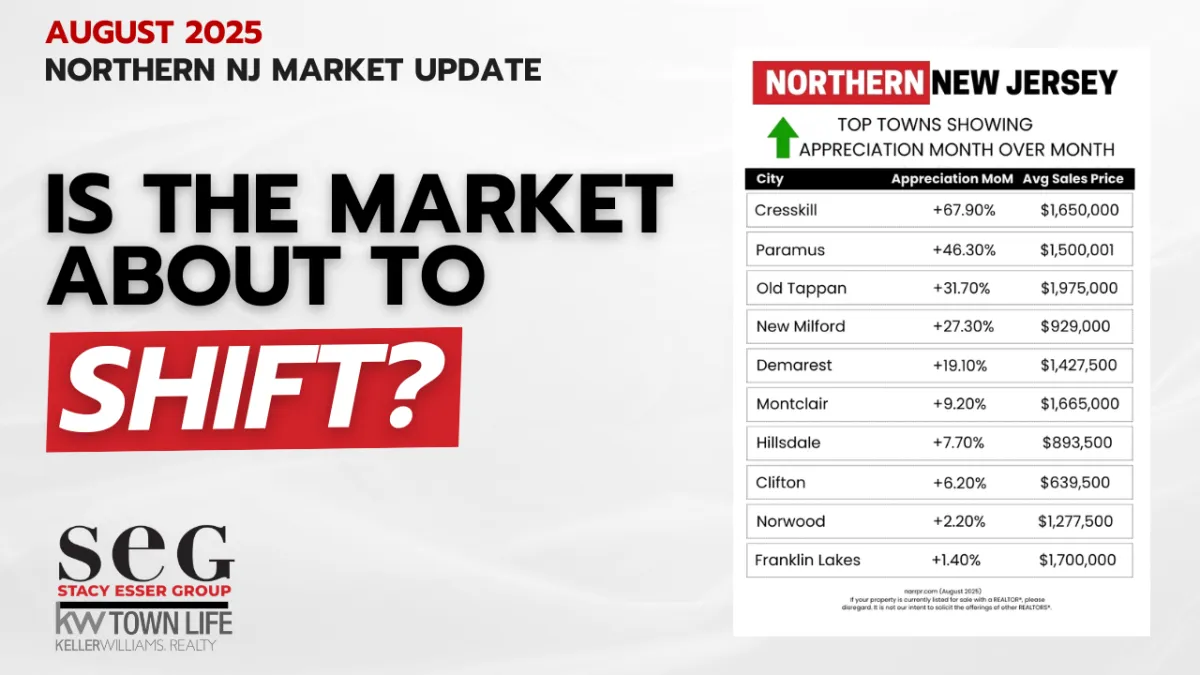

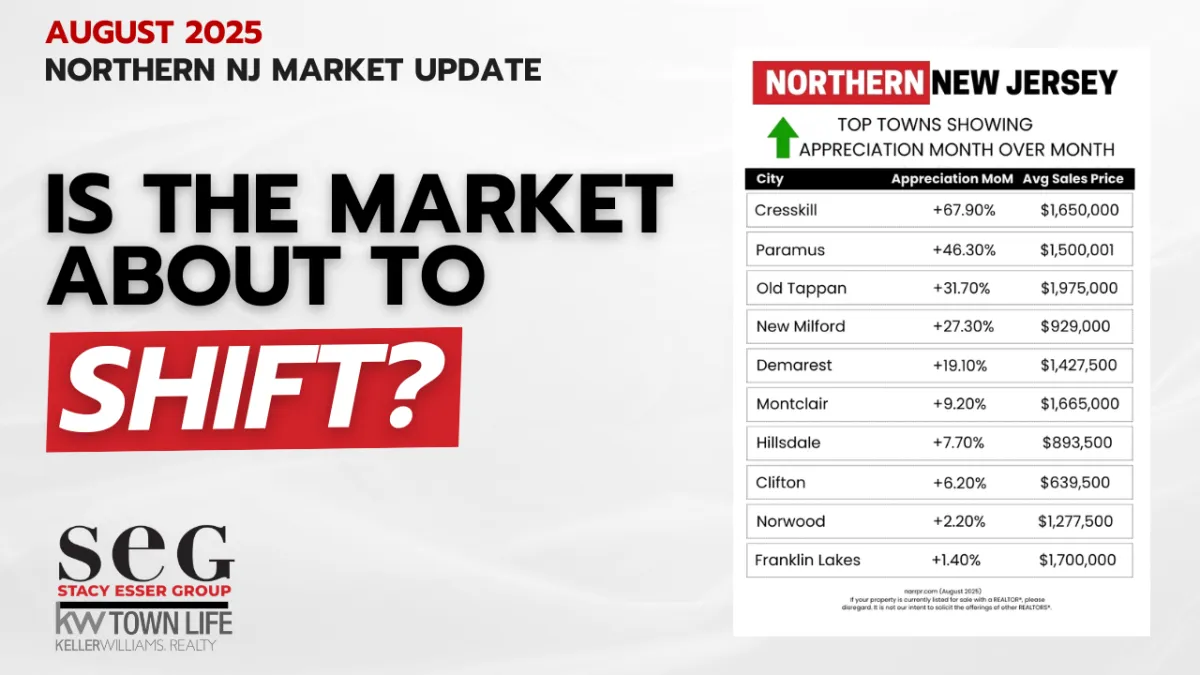

The Northern New Jersey real estate market continues to evolve, leaving buyers and sellers asking: Is it still a seller’s market, or are we starting to shift? With interest rate changes, affordability challenges, and more homes hitting the market, the data tells an important story for anyone looking to buy or sell in our area.

Are Homes in Northern New Jersey Still Selling Quickly?

One of the best ways to measure market momentum is by tracking days on market. Homes in Northern New Jersey are now averaging 30–34 days before going under contract. That’s slightly longer than last year, signaling a softening pace. While this isn’t a drastic change, it does show buyers have a bit more breathing room than in the red-hot market of a few years ago.

Northern NJ Housing Inventory and Sales Trends

Looking at year-to-date data through August 2025:

Closed sales: Flat compared to 2024

Pending sales: Slightly lower

New listings: Slightly higher

This creates a tug-of-war between buyers and sellers. Homes are still selling at strong prices—often 104% of list price—but sellers are facing more pushback. Price reductions are becoming more common, and more listings are quietly coming off the market when sellers don’t meet their price goals.

Affordability Challenges in Northern New Jersey Real Estate

Buyers are feeling the squeeze. Home values have continued to climb, while wages have not kept pace. At the same time, mortgage rates remain elevated. Although the Federal Reserve recently cut the Fed Funds rate, mortgage rates are still hovering higher than many would like.

This gap—between sellers with low mortgage rates (often around 3%) and buyers facing new loans in the 6–7% range—has kept many would-be movers on the sidelines.

What Buyers in Northern NJ Need to Know

Waiting for rates to drop may not be the smartest move. Historically, October and November are the best months for buyers in terms of negotiating and finding the right home. With rates already trending slightly downward, waiting could mean facing more competition when demand picks back up.

Buyers should:

Work with a trusted lender to float their rate

Explore refinance opportunities in the future

Stay focused on long-term goals instead of short-term rate fluctuations

Tips for Home Sellers in Northern New Jersey

Yes, it’s still technically a seller’s market—but overpricing your home is a mistake. Today’s buyers are savvy and cautious, and homes that aren’t priced right are sitting longer or requiring reductions.

Sellers can maximize value by:

Preparing and staging their homes properly

Pricing competitively for the current market

Partnering with a local expert who knows how to negotiate in a shifting environment

Upcoming Luxury

Open Houses

⬇️Get access to Privately Listed Homes For Sale ⬇️

Many sellers choose to list their homes privately before they go public. We have access to 45+ homes for sale in our office exclusives. Don't miss out on the home of your dreams because someone else saw it first. Get access!

Hurry, these spectacular homes go fast!

100% Secure. We value your privacy.

By submitting your email and phone number in the forms on our site, you give

consent to receiving occasional emails and SMS text messages about offers,

or other information, from us.

what's happening around town!

Latest around Northern NJ

Buyers Locked Out of Market

Featured on CBS Mornings, The Buyer struggle across Bergen, Passaic and Hudson County

5 Reasons NOT to Move to Northern NJ in 2024

We'll discuss 5 important factors to consider before making the move to Northern NJ!

Don't Sell Until You Watch this!

Learn 3 Simple ways to know it's time to sell your home! And spoiler alert - it's not the most obvious!

Sell Your Home for Top Dollar in Northern NJ!

How to sell your home for the most money as featured on NBC Today

Upgrading Your Home? Don't do this!

Planning to upgrade your home? 🏠 Before you dive in, make sure to avoid these common mistakes that could negatively impact your home's value!

What you need to know about NAR!

If you are buying in NJ, this video will share exactly what you need to know about hiring a buyers agent!

Top Appreciating Towns

Top 3 Local Event Picks

What's Happening This Month in Northern NJ!

Get our Free Guide to

"Value-Up™ Your Home"

Our Value-Up™ Your Home eBook Was Written To

Give You A Better Understanding of how to transform your home's value in Northern NJ! Get Yours FREE today!

Available for a limited time!

Buying or Selling in Northern NJ? Don't miss out on our latest Fall SEGInsider - A full guide to the housing market in Northern NJ.

Report Cards by Town

Brought to you by Niche.com

Check out Niche's 2024 Best Places to Live in Bergen County here

Bergen County, NJ

Bergen County, New Jersey, has a population of 953,243 and is considered one of the best places to live in the state. Most residents own their homes, and the area offers many bars, restaurants, coffee shops, and parks. It attracts young professionals, with residents generally leaning liberal. The public schools in Bergen County are highly rated.

Tenafly, NJ

Tenafly, a suburb of New York City in Bergen County with a population of 15,299, is one of the best places to live in New Jersey. Most residents own their homes and enjoy a suburban feel with numerous restaurants, coffee shops, and parks. The town attracts families, and residents generally hold moderate political views. Tenafly’s public schools are highly rated.

Oradell, NJ

Oradell, a New York City suburb in Bergen County with a population of 8,208, is considered one of the best places to live in New Jersey. Residents enjoy a suburban feel, with most owning their homes. The town has plenty of coffee shops and parks and is popular among retirees. Oradell residents generally lean conservative, and the public schools are highly rated.

Hawthorne, NJ

Hawthorne, a suburb of New York City in Passaic County with a population of 19,456, offers a dense suburban feel with many restaurants, coffee shops, and parks. It attracts families and young professionals, with residents generally leaning liberal. The public schools are rated above average.

Demarest, NJ

Demarest, a New York City suburb in Bergen County with a population of 4,930, is considered one of the best places to live in New Jersey. It has a rural atmosphere, with most residents owning their homes. The community generally holds moderate political views, and the public schools are highly rated.

Closter, NJ

Closter, a New York City suburb in Bergen County with a population of 8,555, is highly rated as a place to live in New Jersey. It provides a rural feel, and most residents own their homes. The community tends toward moderate political views, and the public schools are highly rated.

Montvale, NJ

Montvale, a New York City suburb in Bergen County with a population of 8,413, is known as one of New Jersey’s top places to live. It offers a sparse suburban atmosphere, with most residents owning their homes. The area attracts many young professionals, and the community generally leans conservative. Montvale’s public schools are highly rated.

Upper Saddle River, NJ

Upper Saddle River, a New York City suburb in Bergen County with a population of 8,313, is highly rated as a place to live in New Jersey. It offers a rural feel, with most residents owning their homes and enjoying the town’s numerous parks. Residents tend to hold moderate political views, and the public schools are highly rated.

Woodcliff Lake, NJ

Woodcliff Lake, a New York City suburb in Bergen County with a population of 6,096, is highly regarded as a place to live in New Jersey. It provides a sparse suburban feel, with most residents owning their homes and enjoying many coffee shops and parks. The community leans conservative, and the public schools are highly rated.

Real Estate Insights, Home Tips & More

Northern New Jersey Real Estate Market Update | Fall 2025 Trends & Insights

Northern New Jersey Real Estate Market Update – Fall 2025

The Northern New Jersey real estate market continues to evolve, leaving buyers and sellers asking: Is it still a seller’s market, or are we starting to shift? With interest rate changes, affordability challenges, and more homes hitting the market, the data tells an important story for anyone looking to buy or sell in our area.

Are Homes in Northern New Jersey Still Selling Quickly?

One of the best ways to measure market momentum is by tracking days on market. Homes in Northern New Jersey are now averaging 30–34 days before going under contract. That’s slightly longer than last year, signaling a softening pace. While this isn’t a drastic change, it does show buyers have a bit more breathing room than in the red-hot market of a few years ago.

Northern NJ Housing Inventory and Sales Trends

Looking at year-to-date data through August 2025:

Closed sales: Flat compared to 2024

Pending sales: Slightly lower

New listings: Slightly higher

This creates a tug-of-war between buyers and sellers. Homes are still selling at strong prices—often 104% of list price—but sellers are facing more pushback. Price reductions are becoming more common, and more listings are quietly coming off the market when sellers don’t meet their price goals.

Affordability Challenges in Northern New Jersey Real Estate

Buyers are feeling the squeeze. Home values have continued to climb, while wages have not kept pace. At the same time, mortgage rates remain elevated. Although the Federal Reserve recently cut the Fed Funds rate, mortgage rates are still hovering higher than many would like.

This gap—between sellers with low mortgage rates (often around 3%) and buyers facing new loans in the 6–7% range—has kept many would-be movers on the sidelines.

What Buyers in Northern NJ Need to Know

Waiting for rates to drop may not be the smartest move. Historically, October and November are the best months for buyers in terms of negotiating and finding the right home. With rates already trending slightly downward, waiting could mean facing more competition when demand picks back up.

Buyers should:

Work with a trusted lender to float their rate

Explore refinance opportunities in the future

Stay focused on long-term goals instead of short-term rate fluctuations

Tips for Home Sellers in Northern New Jersey

Yes, it’s still technically a seller’s market—but overpricing your home is a mistake. Today’s buyers are savvy and cautious, and homes that aren’t priced right are sitting longer or requiring reductions.

Sellers can maximize value by:

Preparing and staging their homes properly

Pricing competitively for the current market

Partnering with a local expert who knows how to negotiate in a shifting environment